Time and time again I have people approach me with questions about Medicare Part D. Medicare is confusing enough without having to understand a whole slew of concepts associated with prescription drug plans. Having to sort through literally hundreds of drug plans to find out who will offer you the greatest savings on your prescriptions is a task that most people aren’t looking forward to. Retirement is supposed to be about enjoying your time, not crunching numbers and fretting about surprise penalties. This is where your broker comes in handy.

You may already know this but it’s imperative that you enroll in a Part D plan within 63 days of your eligibility and the failure to do so will result in a lifetime penalty. There is one exception, if you have “creditable coverage.” If your plan is considered to be offering you coverage that is as good or better than Medicare then you are considered to have “creditable coverage” this case if and when you decide to enroll in Part D you may need to fill out a form proving to your prescription drug plan that your previous plan was in fact “creditable.” Creditable insurance usually includes things like employer or union insurance, TRICARE, Indian Health Services, The Department of Veterans Affairs, CHAMPVA or other comprehensive health insurance.

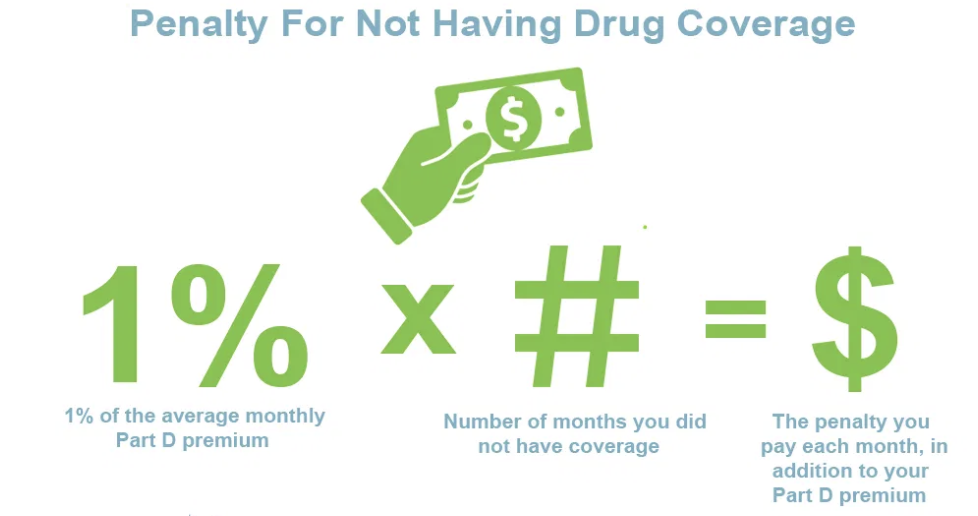

A lifetime penalty sounds pretty serious and you might be curious to know exactly what that entails. It does mean that you will have to pay the penalty for as long you are enrolled in Part D. However, the penalty amount is re-calculated each year based on the new “national base beneficiary premium” amount, so it may go up or down each year. For 2021 the “national base beneficiary premium” is going to be $33.06. and the maximum amount you can be penalized in 2021 is $601.00. The penalty is 1% of the “national base beneficiary premium” multiplied by the number of months after the 63 day grace period that there was a gap between creditable coverage and Part D enrollment.

For example, Ms. Lucille Late procrastinated and did not enroll in her Part D coverage when she first became eligible for it, when she turned 65 in May of 2019. Lucy called DH Retirement Solutions in August of 2020 and was made aware of her lack of creditable coverage! Since Lucille missed her Initial Election Period, she now has to wait until the Annual Election Period in the Fall to enroll in a Part D plan – but that plan won’t become effective till January 1, 2021! By that time Lucille has been qualified for 19 months (May 2019 – January 2021)!

Ms. Lucille Late will pay a penalty of $6.30 each month, in addition to her Part D premium, due to her procrastination! That means that by age 75, she will have paid over $700 in penalties alone! Had she not procrastinated, she could have an extra few hundred bucks in her pocket.

1% x $33.06 = $0.34

$0.34 x 19 = $6.28

Rounded to the nearest $0.10 = $6.30 per month

As you can see, once this concept clicks it is a simple equation. When I help my clients I like to bring visuals if we meet in person or share my screen on a zoom virtual meetings. I feel strongly that Medicare can be more easily understood when it is all laid out in front of you. Medicare has its own language and if you are not yet fluent images offer a universal alternative. My father and I find that a large part of our job is to educate our clients so that they feel empowered during this process instead of defeated.

For more details and for some additional examples you can click here to be redirected to a PDF document published Centers for Medicare & Medicaid Services.

Need help with your Medicare? Call Alicia Hanifin at (888) 539-2111 for all Medicare Plan Services.