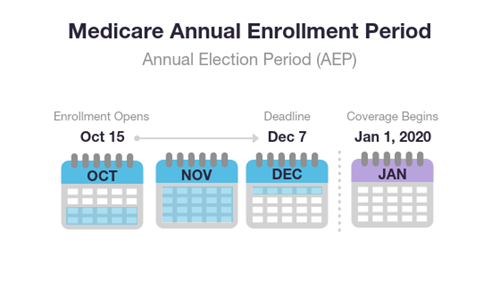

Believe it or not the Annual Election Period is just around the corner (October 15th to December 7th). Here are some tips so that you can stay organized and don’t get overwhelmed by the onslaught of advertisements headed your way. If you are already a DH Retirement Solutions client then you can sit back, relax, and let us do the work for you. Regardless, it’s always nice to be informed!

Here are 5 things that might require you change plans during the AEP:

1. You don’t like the plan changes coming up for the next year

2. Your monthly plan premium is going up

3. You have learned that one of your doctors will no longer be in the network

4. The plan is dropping one of your important medications for next year

5. You want the more comprehensive coverage provided by a Medicare supplement plan

Here’s a helpful checklist to determine if the above list applies to you.

Know your time frame (October 15th-December). This is your time to make a change and all changes will go into effect on January 1st 2021. If you wait until the end of the year you will be too late.

Talk to your doctor’s office about your plan. If you are on original Medicare you can simply ask the question, “will you be accepting Medicare in 2021.” If you are a Medicare Advantage plan holder you will need to ask them about your specific plan. Your provider may not know about the specific plan so it may be best to call the carrier or your broker. Doctors can change networks at any time of year so it’s always important to stay in contact with your provider’s office.

Look out for the Annual Notice of Change (ANOC) packet. This will come in the mail by September 30th if you are enrolled in a Medicare Advantage plan or a Part D drug plan. This is a hefty package with lots of information, but don’t let this intimidate you! If you look at the top of the package there is usually a single page which contains all of the helpful information regarding your plan benefit changes. If they appear to be minor to you, and you haven’t had any changes in providers, medications or general health, then you’re probably all set to stay put for another year. If there have been some substantial changes then you may want to contact your broker immediately.

Every year a plan can change the following (this is not an exhaustive list):

- Copays & Coinsurance

- Provider Network

- Monthly Premium Plan Benefits

- Drug Formulary

- Pharmacy Network

Create a list of your medications. Keep a detailed list with the medication name listed on your pill bottle (this will let your broker know if you are have a brand name or generic). Make sure to also include the dosage and frequency of the medication. When you and your broker check in, they can use this information to make sure you are getting the best deal in 2021!

If you are going to use the Annual Election Period (AEP) to enroll in a Part D drug plan for the 1st time you need to be aware that you could incur a late penalty. This will occur if you had a lapse in creditable coverage. Creditable coverage is a health benefit, prescription drug, or health insurance plan, including individual and group health plans that meet a minimum set of qualifications. It must provide coverage for both brand and generic prescription medication. It must provide the policyholder with several pharmacy options, or a mail-order option. In addition, it must pay at least 60 percent of the cost of prescription expenses.